Choosing the right payment gateway for your e-commerce store is crucial. It affects your sales, customer trust, and overall business success.

Running an online store means handling transactions safely and efficiently. The payment gateway you select can make a big difference. It ensures that your customers’ transactions are smooth and secure. With many options available, it can be confusing to decide which one is best for your business.

You need to consider fees, security features, and compatibility with your store. By understanding these factors, you can make an informed choice that meets your needs and keeps your customers happy.

In this post, we will guide you through the process of selecting the perfect payment gateway for your e-commerce store. Let’s dive in!

Table of Contents

ToggleIntroduction To Payment Gateways

Choosing the right payment gateway is crucial for your e-commerce store. A payment gateway is a service that processes credit card payments for online and offline businesses.

It plays a vital role in ensuring smooth transactions. Understanding its importance can help you make an informed decision.

Importance Of Payment Gateways

Payment gateways ensure secure and fast transactions. They help protect customer data during online purchases. This security builds trust with your customers. Trust is essential for repeat business.

Payment gateways also support multiple payment methods. Customers can use credit cards, debit cards, and digital wallets. Offering these options can increase sales. Some customers prefer specific payment methods.

Role In E-commerce

Payment gateways play a key role in e-commerce. They help process transactions quickly and securely. This speed and security improve the customer experience. A good experience can lead to positive reviews and referrals.

Payment gateways also handle currency conversions. This feature is important for international sales. It allows customers to pay in their local currency. This convenience can attract more global customers.

Payment gateways also offer fraud detection. They monitor transactions for suspicious activity. This helps protect your business from fraud. Reducing fraud can save you money and protect your reputation.

Types Of Payment Gateways

Choosing the right payment gateway for your e-commerce store is vital. There are different types of payment gateways, each with unique features.

Understanding these types will help you make an informed decision. This section delves into the two main types: Hosted Payment Gateways and Self-Hosted Payment Gateways.

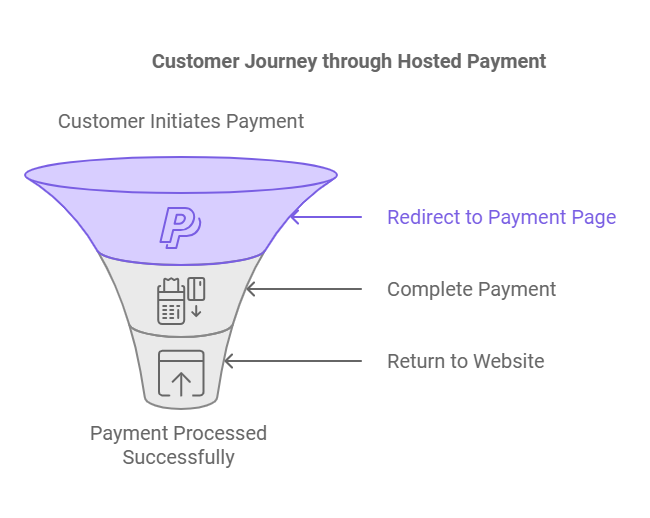

Hosted Payment Gateways

Hosted Payment Gateways redirect customers to the payment service provider’s page. Once the payment is complete, the customer returns to your site. This method offers several advantages:

- Security: The payment provider handles security concerns.

- Easy Integration: Minimal technical skills are needed to set up.

- Compliance: No need for your site to be PCI compliant.

Popular Hosted Payment Gateways include:

| Payment Gateway | Features |

|---|---|

| PayPal | Trusted worldwide, easy to use |

| Stripe | Supports various payment methods, user-friendly |

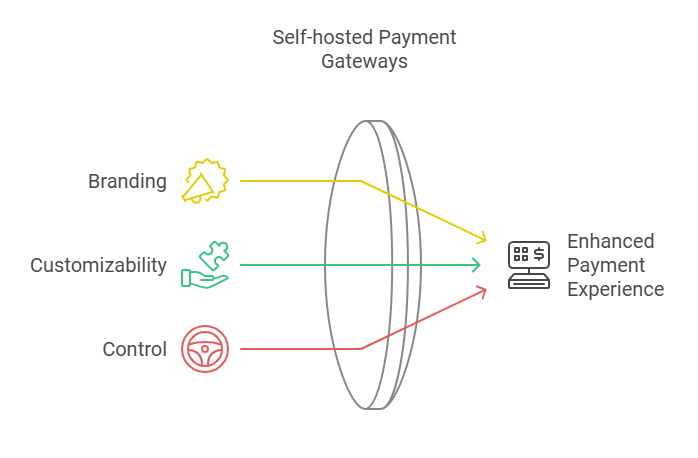

Self-hosted Payment Gateways

Self-Hosted Payment Gateways process payments directly on your site. This method offers full control over the transaction process. Key benefits include:

- Branding: Maintain consistent branding throughout the transaction.

- Customizability: Tailor the payment process to your needs.

- Control: Manage the entire payment experience.

Popular Self-Hosted Payment Gateways include:

| Payment Gateway | Features |

|---|---|

| Authorize.Net | Advanced fraud detection, customizable |

| Worldpay | Supports multiple currencies, robust reporting |

Key Features To Look For

Choosing the right payment gateway is crucial for your e-commerce store. It ensures smooth transactions and builds trust with your customers. Here are the key features to consider:

Security Features

Your payment gateway must have strong security measures. Ensure it offers SSL encryption and is PCI-DSS compliant. These features protect sensitive data from hackers.

Look for fraud prevention tools like AVS (Address Verification System) and CVV (Card Verification Value) checks. These tools reduce the risk of fraudulent transactions.

Consider gateways that offer two-factor authentication (2FA) for added security. This requires users to verify their identity twice, making it harder for unauthorized users to access accounts.

| Security Feature | Importance |

|---|---|

| SSL Encryption | Protects data during transmission |

| PCI-DSS Compliance | Ensures secure handling of card information |

| Fraud Prevention Tools | Reduces risk of fraud |

| Two-Factor Authentication | Enhances account security |

User Experience

A good payment gateway provides a smooth user experience. It should support multiple payment methods like credit cards, debit cards, and digital wallets.

Ensure the gateway offers a seamless checkout process. A complicated process can lead to cart abandonment. Customers prefer quick and easy transactions.

Consider gateways that allow for customizable checkout pages. This makes the process align with your brand’s look and feel, creating a consistent experience for customers.

Customer support is also vital. Choose a gateway that offers 24/7 customer service. This ensures help is available when needed.

- Multiple payment methods

- Seamless checkout process

- Customizable checkout pages

- 24/7 customer service

Cost Considerations

Choosing a payment gateway is crucial for your e-commerce store. One of the most important factors is the cost. Understanding the different fees associated with payment gateways can save your business money. Let’s break down the cost considerations you need to be aware of.

Setup Fees

Some payment gateways charge a setup fee. This is a one-time fee to start using their service. Make sure to check if there are any setup fees before choosing a payment gateway.

Compare the fees among different providers to find the best deal. A lower setup fee can help reduce initial costs for your store.

Transaction Fees

Transaction fees are charges for each transaction processed through the gateway. These fees can vary greatly between providers. They can be a flat rate or a percentage of the transaction amount. It’s important to consider both types of fees.

High transaction fees can eat into your profits, so look for a provider with reasonable rates. Some providers offer lower fees based on your sales volume. Make sure you understand the fee structure to avoid any surprises.

Integration With Your Store

Choosing the right payment gateway for your e-commerce store is crucial. It directly affects your sales and customer satisfaction. Integration with your store plays a significant role in this decision.

Let’s explore two important aspects: ease of integration and compatibility with platforms.

Ease Of Integration

Look for a payment gateway that offers easy integration. This reduces the time and effort needed to get up and running. Many gateways provide API documentation and developer support. These resources help streamline the integration process.

Some gateways also offer plugins or extensions. These tools make it simple to integrate with popular e-commerce platforms. Always check if the gateway provides detailed setup guides and tutorials. This will save you time and potential headaches.

Compatibility With Platforms

Compatibility is another key factor. Ensure the payment gateway works well with your e-commerce platform. Popular platforms like Shopify, WooCommerce, and Magento often have a wide range of supported gateways.

Here’s a quick comparison table of some popular payment gateways and their platform compatibility: Payment GatewayShopifyWooCommerceMagentoPayPalYesYesYesStripeYesYesYesSquareYesYesNoAuthorize.NetYesYesYes

Check the compatibility before making a final decision. This ensures a smooth and hassle-free integration process.

Some gateways may offer additional features like multi-currency support and fraud detection. These features can be beneficial depending on your business needs.

Popular Payment Gateway Options

Choosing the right payment gateway is crucial for your e-commerce store. It ensures secure and smooth transactions.

Let’s explore some popular payment gateway options. Each has unique features and advantages that can suit different business needs.

Paypal

PayPal is a widely recognized payment gateway. It offers a seamless checkout experience. Customers can pay using their PayPal balance, credit cards, or bank accounts.

- Easy to set up and use

- Supports multiple currencies

- Offers buyer and seller protection

PayPal is trusted by millions of users worldwide. It is a good choice for small to medium-sized businesses.

Stripe

Stripe is a powerful payment gateway known for its flexibility. It is designed for developers and offers extensive customization options.

- Supports a wide range of payment methods

- Provides advanced security features

- Has a simple and transparent pricing structure

Stripe is ideal for businesses needing a tailored payment solution. It can handle both online and offline payments efficiently.

Square

Square is a versatile payment gateway. It is perfect for businesses with both online and physical stores. Square offers an easy-to-use interface and a range of features.

- Supports various payment types

- Offers integrated point-of-sale systems

- Provides detailed sales analytics

Square is known for its user-friendly design. It can help businesses manage payments and track sales effortlessly.

Customer Support And Reliability

Choosing the right payment gateway for your e-commerce store is crucial. It’s not just about processing payments. The customer support and reliability of the service play a significant role.

These factors can affect your business operations and customer satisfaction. This section will cover the importance of support services and how downtime and maintenance can impact your store.

Support Services

Customer support is vital for any e-commerce store. Issues can arise at any time. Having access to 24/7 customer support ensures that problems are resolved quickly. Look for gateways that offer multiple support channels. Phone support, live chat, and email support are essential.

Consider the response time. Quick responses help keep your store running smoothly. Check if the payment gateway has a dedicated support team. This can make a big difference during critical times.

Downtime And Maintenance

Downtime can hurt your business. If your payment gateway is down, customers can’t make purchases. This leads to lost sales and frustrated customers. Choose a gateway known for its reliability. Look for services with minimal downtime.

Maintenance is another factor to consider. Regular maintenance is necessary, but it should not disrupt your business. Check the maintenance schedule of the payment gateway. Make sure it fits with your business hours. Some gateways offer maintenance during off-peak hours to minimize impact.

Here’s a table summarizing these key points:

| Factor | Importance |

|---|---|

| 24/7 Customer Support | Ensures problems are resolved quickly |

| Multiple Support Channels | Provides flexibility in communication |

| Quick Response Time | Keeps store running smoothly |

| Minimal Downtime | Prevents lost sales |

| Maintenance Schedule | Minimizes business disruption |

Selecting a reliable payment gateway with excellent support services can make a significant difference. It ensures a smooth experience for both you and your customers.

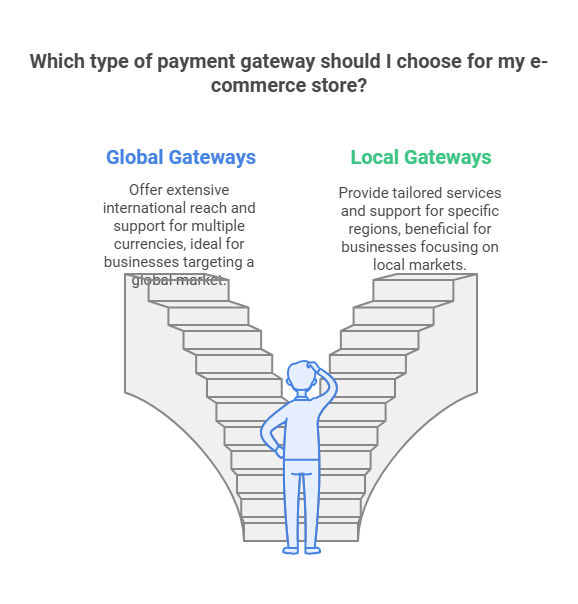

Global Vs. Local Gateways

Choosing the right payment gateway for your e-commerce store is crucial. One significant decision is between global and local gateways. Each has unique features, and understanding them can help you make the right choice.

International Payments

Global payment gateways handle international transactions smoothly. They support multiple currencies and offer a wide range of payment methods. This is essential if you plan to sell products worldwide.

Popular global gateways include PayPal, Stripe, and Square. These platforms ensure secure transactions and provide robust fraud protection. They also integrate easily with many e-commerce platforms.

Using a global gateway can enhance your store’s credibility and attract more international customers. It also simplifies the payment process for buyers from different countries.

Local Payment Preferences

Understanding local payment preferences is vital. Different regions prefer different payment methods. For instance, in some countries, credit card usage is low. Instead, people might prefer bank transfers or local payment methods.

Local gateways, like iDeal in the Netherlands or Alipay in China, cater specifically to these preferences. These gateways often offer lower fees for transactions within their region.

Integrating local gateways can increase your conversion rates in specific markets. They provide payment options that customers are familiar with and trust.

| Feature | Global Gateways | Local Gateways |

|---|---|---|

| Currency Support | Multiple Currencies | Local Currency |

| Payment Methods | Various Options | Region-Specific Methods |

| Transaction Fees | Higher Fees | Lower Fees |

| Integration | Easy with Most Platforms | Depends on Region |

| Customer Trust | High for International Buyers | High for Local Buyers |

- Choose global gateways for international reach.

- Opt for local gateways to cater to specific markets.

Both global and local gateways have their advantages. Your choice depends on your business goals and target audience.

Testing And Optimization

To ensure your e-commerce store runs smoothly, testing and optimization of your payment gateway is critical. These processes help identify issues and improve the user experience. By optimizing, you can reduce cart abandonment rates and increase sales.

A/b Testing

A/B testing is a method to compare two versions of a payment gateway to see which performs better. You can test various elements such as:

- Button colors

- Checkout page layout

- Form fields

Run the test for a set period and analyze the results. This helps you understand what changes lead to higher conversion rates. Use tools like Google Optimize or Optimizely for this purpose.

Performance Monitoring

Performance monitoring ensures your payment gateway operates efficiently.

Monitor the following metrics:

| Metric | Description |

|---|---|

| Transaction Speed | Time taken to complete a transaction |

| Success Rate | Percentage of successful transactions |

| Error Rate | Frequency of transaction failures |

Use tools like New Relic or Datadog for monitoring. Regularly check these metrics to ensure your gateway is reliable. Address any issues promptly to maintain a smooth payment process.

Conclusion And Recommendations

Selecting the right payment gateway ensures smooth transactions and customer satisfaction. Consider security, fees, and integration with your platform. This approach helps boost your e-commerce store’s success.

Choosing the right payment gateway is crucial for your e-commerce store’s success. It affects your sales, customer trust, and overall business growth. After considering various factors like fees, security, and customer support, you will be able to make an informed decision.

Final Thoughts

A good payment gateway should meet your business needs. It should be easy to integrate and use. It should also offer strong security features. Keep an eye on transaction fees. High fees can eat into your profits.

Expert Recommendations

Experts suggest looking for a gateway with strong fraud protection. This keeps your business and customers safe. Choose a gateway with excellent customer support. This is crucial if issues arise. Another key point is to check if the gateway supports multiple currencies. This can help you reach a global audience.

Mobile payment support is also important. Many customers now shop from their phones. In short, the best payment gateway should be reliable, secure, and cost-effective. Take your time to research and choose wisely.

Frequently Asked Questions

What Is A Payment Gateway?

A payment gateway is a service that authorizes and processes online transactions for e-commerce stores. It ensures secure, encrypted transactions.

Why Is Choosing A Payment Gateway Important?

Choosing the right payment gateway ensures secure, fast, and reliable transactions for your customers. It impacts user experience and trust.

How To Compare Payment Gateways?

Compare payment gateways by looking at fees, security features, compatibility with your platform, and customer support. Consider user reviews.

What Security Features To Look For?

Look for PCI compliance, encryption, fraud detection, and secure socket layer (SSL) certificates. These features ensure transaction safety.

Conclusion

Choosing the right payment gateway boosts your e-commerce success. Prioritize security and compatibility. Compare fees and customer service options. Test the gateway before finalizing. A smooth payment process keeps customers happy. Remember, a good choice supports your business growth.

So, pick wisely and watch your store thrive.