An e-commerce payment gateway is essential for online businesses. It processes payments securely and efficiently.

In the digital age, online transactions have surged. Businesses need a reliable way to accept payments. This is where e-commerce payment gateways come in. They act as intermediaries between customers and merchants. These gateways ensure payments are processed safely. They protect both parties from fraud.

Understanding how these gateways work is crucial. It helps businesses choose the right solution. It also ensures smooth, secure transactions.

In this blog post, we will explore the basics. We’ll explain what e-commerce payment gateways are. And why they are vital for your online store. Get ready to dive into the world of digital payments.

“An eCommerce payment gateway is a software used by merchants to accept, manage, and process credit or debit card transactions online. In simple terms, an eCommerce payment gateway is a middleman between online merchants and their customers and the checkout portal you see on online stores”

Table of Contents

ToggleE-commerce Payment Gateways

In the digital age, online shopping is more popular than ever. With this rise, the need for secure and efficient payment methods has increased. E-commerce payment gateways play a crucial role in this process. They ensure smooth transactions between buyers and sellers on the Internet.

Definition And Purpose

An e-commerce payment gateway is a technology that allows online stores to process payments. It acts as a bridge between the customer and the merchant’s bank. When a customer makes a purchase, the gateway securely transfers payment information. This ensures that the transaction is safe and quick.

The main purpose of a payment gateway is to authorize payments. It ensures the customer’s funds are available and transferred to the seller. This process involves encrypting sensitive information to protect it from fraud.

Importance In Online Transactions

Payment gateways are vital for online transactions. They provide a secure environment for processing payments. Without them, e-commerce would be prone to security breaches and fraud. Payment gateways also help build trust with customers. When customers see trusted payment options, they feel more confident buying from an online store.

Moreover, payment gateways offer convenience. They support various payment methods like credit cards, debit cards, and digital wallets. This flexibility caters to different customer preferences, enhancing the shopping experience.

In summary, e-commerce payment gateways are essential for secure and efficient online transactions. They protect sensitive information, ensure quick payments, and build customer trust.

How Payment Gateways Work

E-commerce payment gateways are crucial for online transactions. They ensure secure payment processing between customers and businesses. Understanding how they work is important for any online store owner. This section will explain the process in simple steps.

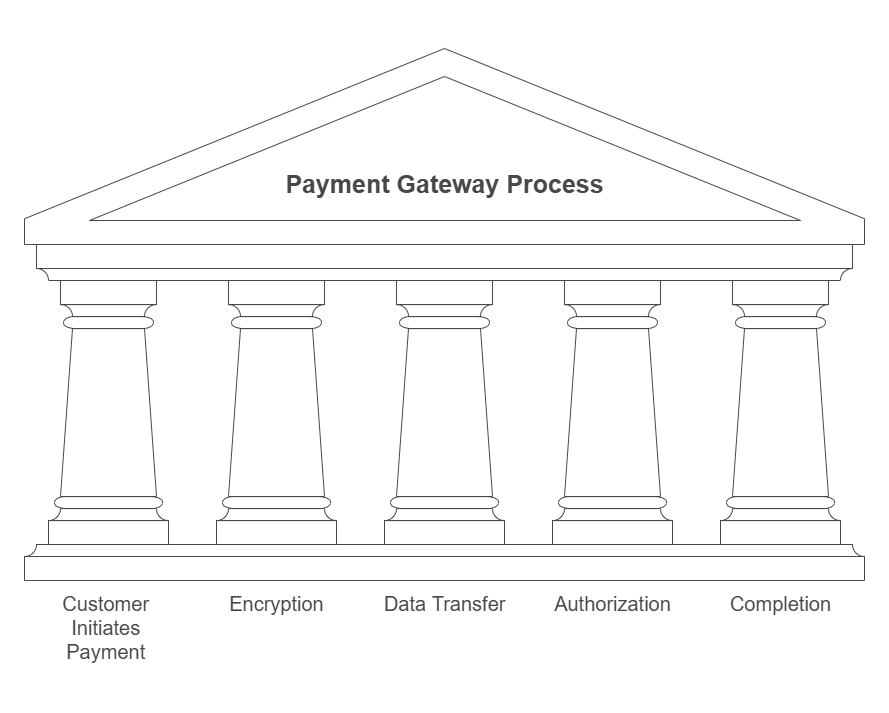

Transaction Process

Payment gateways work through a series of steps. Here’s a detailed look:

- Customer Initiates Payment: The process starts when a customer places an order and submits payment details.

- Encryption: The payment gateway encrypts the data for security.

- Data Transfer: The encrypted information is sent to the payment processor.

- Authorization: The payment processor forwards the details to the customer’s bank for authorization.

- Approval or Decline: The bank approves or declines the transaction and sends a response back.

- Completion: The payment gateway informs the merchant of the result, and the transaction is completed.

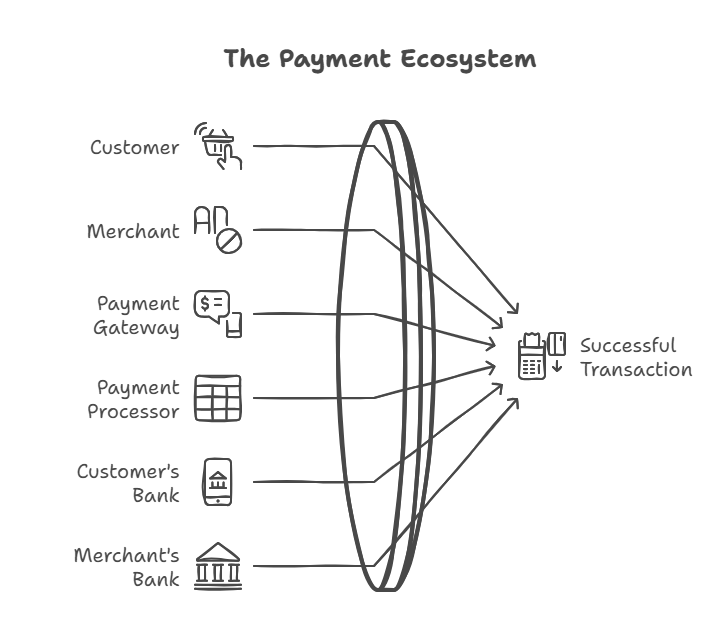

Parties Involved

Several parties play roles in the payment gateway process:

- Customer: The person buying goods or services.

- Merchant: The business selling the goods or services.

- Payment Gateway: The service that processes the payment.

- Payment Processor: The company that handles the transaction details.

- Customer’s Bank: The bank issuing the payment method (credit/debit card).

- Merchant’s Bank: The bank where the merchant receives the funds.

Each party ensures the transaction is secure and successful. Understanding their roles helps in troubleshooting potential issues.

Types Of Payment Gateways

Understanding the types of payment gateways is crucial for any e-commerce business. Each type offers unique features and benefits. Let’s explore them.

Hosted Gateways

Hosted gateways redirect customers to the payment processor’s website. This type is simple and secure. The payment processor handles all transaction details. After payment, customers return to your site. Hosted gateways are easy to set up and require less maintenance.

Self-hosted Gateways

Self-hosted gateways process payments on your website. Customers enter their payment details directly on your site. You then send the data to the payment processor. This type gives you more control over the checkout experience. It requires more security measures and technical expertise.

Api/non-hosted Gateways

API or non-hosted gateways offer the most flexibility. They allow you to integrate payment processing directly into your site. Customers stay on your site during the entire transaction.

You need to handle security and compliance. This type provides a seamless user experience. It requires significant technical skills and resources.

Key Features To Look For

Choosing the right e-commerce payment gateway can greatly impact your business. You need to consider several features to ensure smooth transactions. Here are the key features to look for in an e-commerce payment gateway.

Security Measures

Security is the top priority for any e-commerce transaction. Your payment gateway should use strong encryption methods. Look for PCI DSS compliance. It ensures that your customers’ data is safe. Fraud detection tools are also essential. They help in identifying and preventing fraudulent activities.

User Experience

A good payment gateway should be easy to use. It should have a simple, intuitive interface. Checkout processes must be quick and seamless. Customers prefer gateways that allow multiple payment options.

This flexibility can enhance their shopping experience. Ensure that the payment gateway is mobile-friendly. Many users shop through their smartphones.

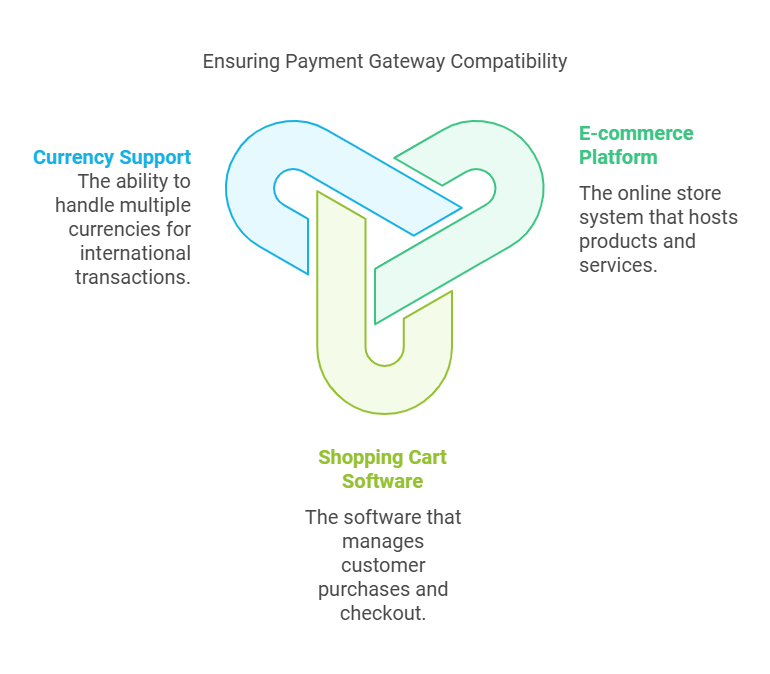

Compatibility

Your payment gateway should integrate easily with your e-commerce platform. Check for compatibility with your shopping cart software. It should also support the currencies used by your target audience. This ensures smooth international transactions.

Compatibility with other business tools can streamline your operations. For example, integrating with accounting software can simplify your financial management.

Popular Payment Gateway Providers

E-commerce payment gateways are essential for online businesses. They facilitate secure transactions between customers and merchants. Choosing the right payment gateway provider is crucial for success. Several popular providers dominate the market. Below, we will discuss some of the top options.

Paypal

PayPal is a widely trusted payment gateway. It offers extensive features and a user-friendly interface. Businesses can easily integrate PayPal into their websites. Customers appreciate its security and convenience.

Stripe

Stripe is known for its developer-friendly tools. It supports a wide range of payment methods. Stripe is ideal for businesses that require customization. Its robust API allows for flexible integration.

Square

Square provides a comprehensive payment solution. It is popular among small businesses and startups. Square offers both online and offline payment options. The platform is easy to set up and use.

Authorize.net

Authorize.Net has been a reliable payment gateway for years. It supports multiple currencies and payment methods. The service includes fraud protection and secure transactions. Businesses benefit from its extensive features and reliability.

Integration With E-commerce Platforms

Integrating an e-commerce payment gateway with your online store is crucial. It ensures smooth transactions and a better user experience. Different platforms offer varied integration processes. Let’s explore how popular e-commerce platforms handle this.

Shopify

Shopify is known for its ease of use. Integrating a payment gateway here is straightforward. Navigate to the payment settings in your dashboard. Choose your preferred gateway from the list. Follow the instructions provided. Within minutes, your gateway is set up. Your customers can now make secure payments.

Woocommerce

WooCommerce is a popular WordPress plugin. It offers flexibility and many customization options. To integrate a payment gateway, go to the WooCommerce settings. Select the ‘Payments’ tab. Choose your desired gateway and configure it. The process is simple and quick. Your store will be ready to accept payments.

Magento

Magento is a powerful e-commerce platform. It offers robust features for large stores. Integrating a payment gateway requires some technical knowledge. Access the Magento admin panel.

Navigate to the ‘Sales’ section. Select ‘Payment Methods’ and configure your gateway. This setup ensures secure transactions for your customers.

Bigcommerce

BigCommerce is another user-friendly platform. It supports various payment gateways. To integrate one, go to your BigCommerce control panel. Click on ‘Store Setup’ and then ‘Payments’. Choose your gateway and follow the steps. The integration process is seamless. Your store can start accepting payments quickly.

Costs And Fees

Understanding the costs and fees associated with an e-commerce payment gateway is crucial for online businesses. These costs can affect your bottom line and influence your decision-making process. Below, we’ll break down the main cost components.

Transaction Fees

Transaction fees are the charges incurred each time a customer makes a purchase. These fees can vary based on the payment gateway provider. They typically include a percentage of the transaction amount and a fixed fee per transaction. For example:

| Provider | Percentage Fee | Fixed Fee |

|---|---|---|

| PayPal | 2.9% | $0.30 |

| Stripe | 2.9% | $0.30 |

These fees may seem small, but they add up quickly. It’s essential to calculate these costs to understand their impact on your profit margins.

Setup And Maintenance Costs

Setting up an e-commerce payment gateway may involve initial setup fees. These are one-time charges for integrating the gateway with your website. Some providers offer free setup, while others may charge a fee.

In addition to setup costs, there are maintenance fees. These are recurring charges for keeping the payment gateway operational. Maintenance fees can include:

- Monthly service fees

- Annual renewal fees

- Software update costs

Consider these expenses when budgeting for your e-commerce platform. Knowing these costs helps you choose a provider that fits your budget.

Future Trends In Payment Gateways

The future of payment gateways is rapidly evolving. Businesses must keep up with these changes to stay competitive. Emerging technologies are reshaping how transactions occur. Here are some key trends to watch.

Cryptocurrency Payments

Cryptocurrency is gaining popularity for online transactions. Payment gateways are starting to accept Bitcoin, Ethereum, and other digital currencies. This offers more options for customers. It also reduces transaction fees. With blockchain technology, payments are more secure and transparent. This trend is likely to grow as more people adopt cryptocurrencies.

Mobile Wallets

Mobile wallets are becoming a common payment method. They provide convenience and speed. Customers can store their card details securely on their phones. They can then pay with a simple tap or scan. Popular mobile wallets include Apple Pay, Google Wallet, and Samsung Pay. Businesses that accept mobile wallets can attract more tech-savvy customers.

AI and Machine Learning

AI and machine learning are transforming payment gateways. These technologies help detect and prevent fraud. They can analyze transaction patterns in real time. This ensures only legitimate transactions go through.

AI can also improve customer service. It can offer personalized payment experiences based on user behavior. This makes the payment process smoother and more efficient.

Choosing The Right Payment Gateway

Choosing the right payment gateway is crucial for your e-commerce success. It ensures smooth transactions and builds customer trust. But how do you pick the best one? Let’s break it down into simple steps.

Business Needs Assessment

First, evaluate your business needs. Consider your target market. Are they local or international? This affects the payment methods you need. Think about your sales volume. High sales volumes require robust gateways.

Also, consider your budget. Some gateways charge setup fees. Others have monthly fees or transaction charges. Choose one that fits your financial plan. Don’t forget security. Ensure the gateway complies with PCI DSS standards.

Comparing Providers

Next, compare different providers. Look at their features. Do they support multiple currencies? Can they handle various payment methods? Check their integration process. Some gateways are easier to integrate than others.

Review their customer support. Good support can save you time and headaches. Read user reviews. They offer real-world insights into reliability and service quality. Lastly, consider the provider’s reputation. Established companies often offer better security and reliability.

Frequently Asked Questions

What Is An E-commerce Payment Gateway?

An e-commerce payment gateway is a service that processes online payments. It securely transfers payment data between the customer, merchant, and bank.

How Does A Payment Gateway Work?

A payment gateway encrypts and transmits payment details from the customer to the merchant’s bank. It ensures secure transactions.

Why Do Online Stores Need Payment Gateways?

Online stores need payment gateways to securely process customer payments. They help prevent fraud and ensure safe transactions.

What Are The Benefits Of Using Payment Gateways?

Payment gateways offer secure transactions, fraud prevention, and seamless payment processing. They improve customer trust and convenience.

Conclusion

Understanding e-commerce payment gateways is crucial for online businesses. They ensure secure transactions. This builds trust with customers. Choosing the right gateway impacts sales. Research options carefully. Consider fees, security, and features. Remember, a smooth checkout process enhances user experience.

Invest time in selecting the best solution. Your business will benefit.